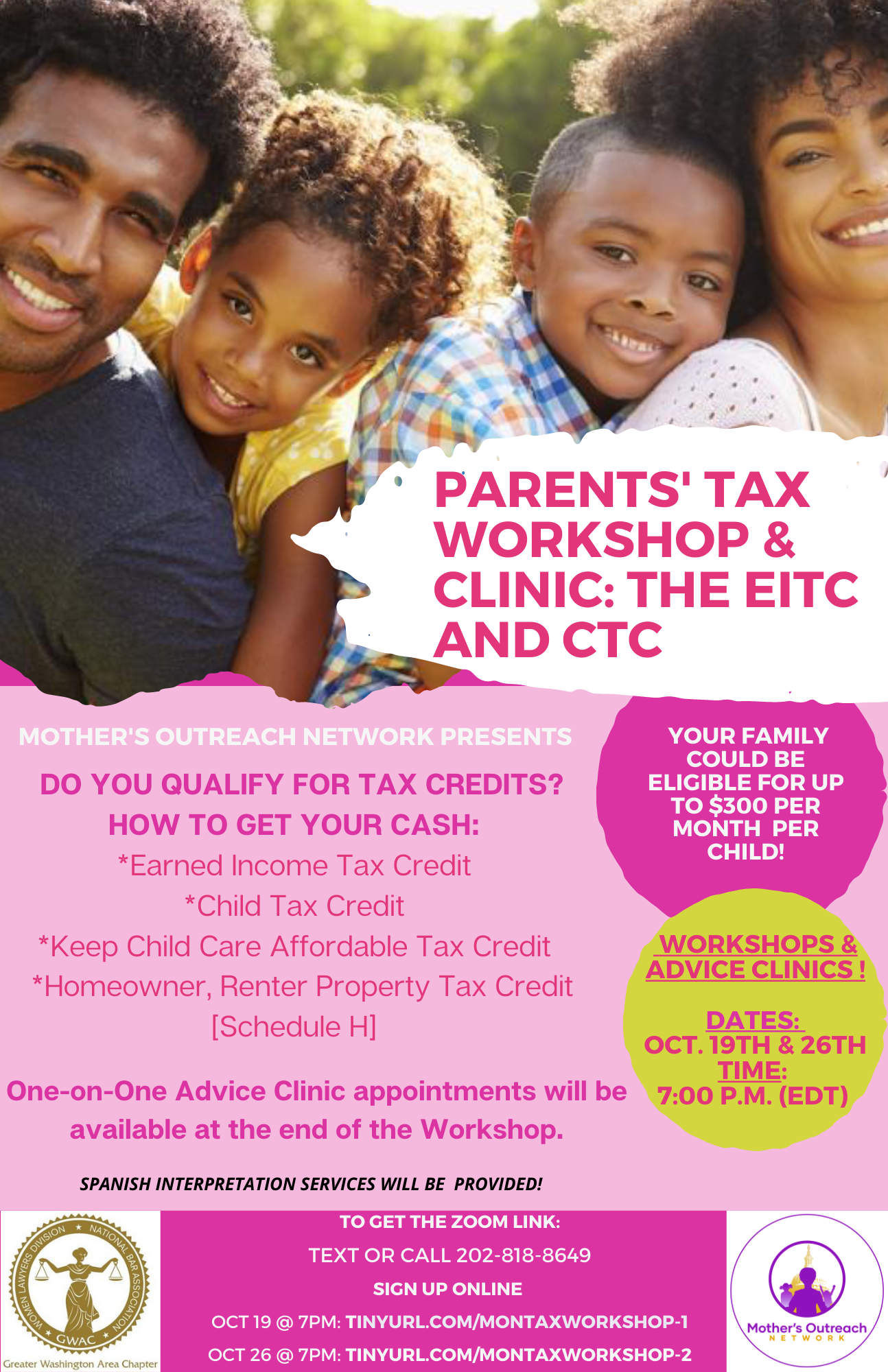

AJE is excited to share this Online Parent’s Tax Workshop & Brief Advice Clinic with our community!

Mother’s Outreach Network and GWAC Bar Association, in partnership with Elena Fowlkes, the D.C. Office of Tax and Revenue Taxpayer Advocate, and David Fischer, partner at Crowell & Moring LLP, will be hosting free tax workshops, followed immediately by one-on-one brief advice clinics that will address individuals’ specific questions, all available only via Zoom.

For 2021, the Child Tax Credit (CTC) and the Earned-Income Tax Credit (EITC) were expanded, greatly increasing benefits available for low-income families and individuals, growing the pool of individuals eligible for these benefits, and permitting cash payments regardless of taxable income. Lacking awareness that they are eligible for these credits, lacking knowledge of how to file for their refund, or possessing questions and concerns about their particular situation that make them reticent to claim their tax benefits – many individuals, including in Washington DC, have not accessed the refundable credits for which they qualify.

The workshops will inform D.C. parents and caregivers about their eligibility for federal and DC refundable tax credits at workshop information sessions and will assist parents through one-on-one Brief Advice Clinics appointments that will be available immediately after the workshop.

The Parents’ Tax Workshop and Brief Advice Clinic: EITC and CTC dates and details are as follow

To get the Zoom link:

- Text or Call 202-818-8649.

- Alternatively, sign up online:

- Tuesday, October 19th at 7 pm – Sign up at https://tinyurl.com/MONTaxWorkshop-1

- Tuesday, October 26th at 7 pm – Sign up at https://tinyurl.com/MONTaxWorkshop-2

Spanish interpretation services will be provided.

Leave a Reply